Ano ang Income Statement?

Ang kita (profit) ay ang masasabing dugo na nagpapadaloy at bumubuhay sa isang negosyo. Sa pamamagitan nito ay nagagawang matugunan ng isang business ang mga pang araw-araw nyang gastusin at nagagawa nyang mag-expand dahil may excess syang kinita para ma-iinvest sa ibang bagay.

Napakahalagang bagay ang kita para sa mga investment analyst, lalung lalo na sa pagdedetermine kung nararapat bang mag-invest o maglagak ng pera sa isang kumpanya. Ang mga datos na may kinalaman sa kinita ng isang business ay makikita sa tinatawag na Statement of Comprehensive Income.

Financial statements are probably the most important resource for any individual investor. All companies with stock trading on the Philippine Stock Exchange, the United States Stock Exchange (Dow Jones, Nasdaq, S&P, etc. are required to file financial statements with the Securities and Exchange Commission (SEC) each quarter.

Statement of Comprehensive Income

Ang Statement of Comprehensive Income ay ang nagpapakita ng pagbabago sa equity ng isang kumpanya sa loob ng isang period bunga ng mga transaksyon o mga bagay, maliban sa mga pagbabago na ibinunga ng transaksyon mula sa mga owners ng kumpanya.

Sa madaling salita, ito ay naglalaman ng mga kinita (income) o ikinalugi (loss) ng isang business sa kanyang operasyon.

Ang Statement of Comprehensive Income ay naglalaman ng:

- Income Statement – naglalaman ng financial performance ng kumpanya isang period.

- Statement of Other Comprehensive Income – ito ay nagpapakita ng mga income at expense items na hindi kasama sa income statement ayon sa alituntunin ng IFRS accounting standards.

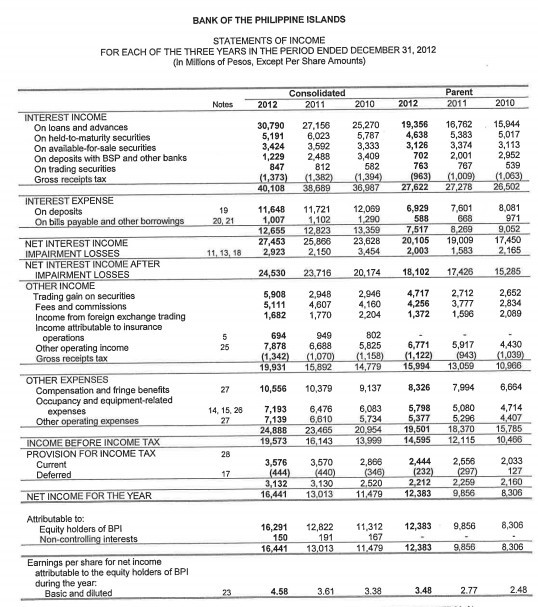

Makikita sa ibaba ang audited income statement ng Bank of the Philippine Islands para sa taong 2012.

Ano ang nilalaman ng isang Income Statement?

Sa income statement makikita ang kinita ng kumpanya at ang mga naging expenses nito sa loob ng isang period. Ang net income ay makukuha sa pamamagitan ng pagbawas ng mga expenses sa income. Nakasaad sa baba ang mga components ng isang income statement. Mahalagang tandaan na ang pagkakaayos ng mga items sa isang income statement ay karaniwang nakadepende sa primary income ng isang kumapanya na kung saan ang major contributor sa income ay inuuna ng pwesto sa income statement.

INCOME

Ang income ay ang dagdgag na economic benefit sa loob ng isang period sa pamamagitan ng inflow o pag-angat ng asset o pagbaba ng liability sa pamamagitan ng pag-angat ng equity na dulot ng mga bagay maliban sa contribution ng mga owners. Ang mga items na maituturing na income ay ang mga sumusunod:

- Net Sales = Gross Sales – Sales Return and Allowance – Sales Discount

Ito ay ang Revenue na ibinawas na ang mga produkto o serbisyong ibinalik dahil sa ito’y sira o hindi maayos ang pagkakagawa, ibawas mo pa ang discount na ibinigay sa isang customer. Ang revenue ang pangunahing pinagkukunan ng kita ng isang negosyo at ito’y nagmula sa pangunahing negosyo ng isang business.

Halimbawa nito ay ang Globe na ang pangunahing kita ay nagmumula sa mga subscription fee na ibinabayad ng mga customer para sa kanilang landline o cellphone.

- Gross Income = Net Sales – Cost of Sales

Ito ang tawag sa tubo mula sa mga naibenta bawas na ang direktang ginastos sa paggawa nito.

- Other Income

Dito naman makikita ang iba pang kita ng kumpanya na hindi bunga ng pangunahing negosyo nito. Halimbawa nito ay ang interest revenue na kinita mula sa interest nito mula sa bangko o maging sa dividend na natanggap nya mula sa pinanghahawakan nyang shares. Maari rin mapunta dito ang lahat ng gains sa pagkakabenta nya ng kanyang opisina sa Makati o maging ang kinita sa pagbebenta ng mga gamit mula sa opisina.

- Investment Income

Sa bahaging ito makikita ang mga kinita mula sa investments ng kumpanya gaya na lamang sa investment in stocks, at iba pa.

Halimbawa nito ay kung bumili ang kumpanya ng shares ng ABS-CBN at ang binili nya ay 15% ownership, ang kita sa pagtaas ng market price nito ay maituturing na isang investment income.

EXPENSES

Ang expense ay ang tawag sa kabawasan sa economic benefit sa loob ng isang period sa pamamagitan ng outflow o pagbaba ng asset o pagtaas ng liability sa nagreresulta sa pagbaba ng equity maliban sa kontribusyon ng mga owners.

- Cost of Sales = Ito ay ang direktang gastos sa pagbuo ng isang produkto o serbisyo. Ang formula nito ay ang sumusunod:

Beginning Inventory + Purchases + Freight In – Purchase Return and Allowances – Purchase Discount – Ending Inventory

- Distribution Costs o Selling Expense – Ito ay ang mga gastusin na direktang sanhi ng selling, advertising, at ang pagdeliver ng produkto sa mga customers. Ito ay karaniwang binubuo ng salary at commission ng tagabenta (salesmen), travelling at marketing expenses, advertising at publicity expenses, at iba pang mga expenses na related sa selling.

- Administrative expenses – Ito ay ang mga gastusin sa pag-aadminister o pagpapatakbo ng negosyo. Dito pumapasok ang lahat ng mga expenses na hindi maikakategorya sa cost of sales at sa selling expenses ngunit kinakailangan upang mapatakbo ang isang business. Halimbawa nito ay ang salary ng mga nasa opisina ng kumpanya gaya ng nasa accounting at credit department, office supplies, depreciation ng office building, at iba pa.

- Other Expenses – Ito naman ay ang tawag sa expenses na hindi direktang related sa selling at pag-aadminister ng isang negosyo. Ilan sa mga items na bumubuo rito ay ang loss on sale ng property, plant, and equipment, loss on sale of long-term investments, at iba pa. Importanteng tandaan na ito ay mga gastusing hindi direktang sanhi ng principal na operasyon ng isang negosyo.

Financial statements are the report card of business.

All that information is available to you, free of charge. Many of the financial statements you need to understand a company are contained in the annual report.

Financial statements are similar to a company's medical charts, and you are the doctor who is employing these charts to determine a diagnosis of the company's financial health.

Here are the key salient financial statements:

Balance sheet

The balance sheet is a snapshot of a company's financial position. The balance sheet reveals a firm's financial resources (their assets) and obligations (their liabilities) at a given moment in time. The asset column determines how well the company has done in handling its finances. On the other hand, the liabilities column does shows to whom and what the company is indebted to.

Income statement

The income statement summarizes a firm's financial transactions over a defined period of time, whether it's a quarter or a whole year. This means the money the company gains/ earns from engaging yourself into productive activities. On the other hand, expenses are the amount of money required to meet the company’s basic needs and other important needs necessary to live to exist. The income statement shows you money coming in (revenues, also known as sales) versus the expenses tied to generating those revenues.

Cash flow statement

Cash flow statements report a company’s inflows and outflows of cash. This is important because a company needs to have enough cash on hand to pay its expenses and purchase assets. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. A company's sole reason for existing is to generate cash that can be distributed to shareholders. This dynamic is called a "positive cash flow."

Your financial statements are the basics of your financial literacy which in turn determines your level of financial intelligence. Financial intelligence is the foundation upon which you can create wealth. Whether you are a new investor, a small business owner, a manager, an executive, a non-profit director, or just trying to keep track of your personal finances, you need to understand how to read, analyse, and create financial statements so you can get a full and accurate understanding how much money there is, how much debt is owed, the income coming in each moth, and the expenses going out the door.

Sa susunod kong article, aking naman ipapalawanag ang konsepto ng Balance Sheet at ang Financial Ratio analysis ng sa gayo’y mas madali mong matukoy kung nararapat bang mag-invest sa kumpanyang iyong papasukin.