Sa pag-aanalyze ng isang stock o investment, papaano ba natin malalaman kung ang performance at estado ng isang kumpanya ay maayos at nakakaangat sa mga competitors nito?

Ang kasagutan dyan ay sa pamamagitan ng financial ratio analysis. Ang layunin nitong ratio ay kumuha ng importanteng mga datos mula sa financial statement ng kumpanya at ilatag ito sa mga formulas ng sa ganon ay makuha ang pagkakaiba nito sa ibang kumpanya. each quarter. Financial statements are the report card of business.

Makikita ang difference sa performance at estado ng kumpanya sa mga competitors nito sa pamamagitan ng ratio analysis dahil inihahamabing ng ratio ang dalawang magkaparehong estado ng business gaya ng net sales, total debt, etc.

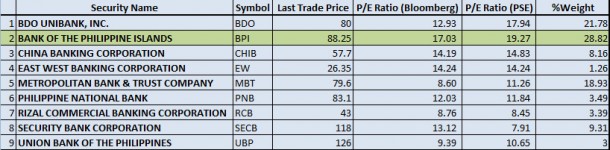

Makikita sa larawan ng isang halimbawa ng P/E Ratio ng mga bangko na nakarehistro sa PSE.

Napakaraming klase ng Financial Ratios na maaaring magamit upang maasess ang estado ng isang negosyo. Aking inilahad sa baba ang pinaka gamit na mga ratio upang matukoy ang pinaka-angkop na stock na pwede mong pasukin.

Liquidity Ratios

- Current Ratio = Current Assets/ Current Liabilities

Ang Current Ratio ang sumusukat kung may kakayahan ang kumpanya na bayaran ang kanyang mga short-term liabilities gaya ng trade payables at current liabilities sa pamamagitan ng mga current assets nito gaya ng cash, receivables, and inventories. Ito ay mahalagang malaman upang matukoy kung ang kumpanya ay posibleng maka-experience ng problema sa cash flow in the near term.

Ang ratio na 2:1 ay kadalasang benchmark subalit depende ito sa industriyang tinitignan. Kapag ang ratio ay less than 1, sinasabi nitong ang kumpanya ay may hindi sapat na resources upang matugunan ang kanyang mga obiligation sa short term at posibleng makaexperience ng kakulangan sa cash.

- Profit Before Depreciation and Amortization to Current Liabilities = Net Operating Profit before tax + Non-cash charges/ Current Liabilities

Ang ratio na ito ay malimit na ginagamit ng mga investment analyst dahil sa ito’y nagpapahiwatig ng margin of safety para matugunan ang mga short-term obligations ng kumpanya gamit ang cash flow na nagmula sa trading operations nito.

Medyo risky ang mga kumpanya na may mababang margin of safety kumpara sa mga kumpanyang may mataas na margin of safety para sa mga current obligations nito. Kaya’t mas mainam na mas mataas ang resulta ng ratio na ito.

- Operating Cash Flow to Current Liabilities = Operating Cash Flow/ Current Liabilities

Ang operating cash flow ng isang kumpanya ay ang cash na nagmula sa operations ng company (revenue – operating expenses + depreciation). Ito ay mas tamang basehan ng profitability ng isang negosyo kung ihahambing sa net income dahil ibinabawas lamang nito ang actual cash expenses (hindi kasama ang depreciation at amortization) na nakapagbibigay ng tamang indikasyon ng lakas ng operations ng kumpanya.

Kung mas mataas ng resulta ng ratio nito, ay mas mainam ito dahil isinasaad nito na mas may kakayahan ang kumpanya na bayaran ang kanyang mga short-term obligations gamit ang kanyang na-produce na cash flow.

- Cash Balance to Total Liabilities = Cash Balance/ Total Liabilities

Ang ratio naman na ito ay tumutukoy sa kakayahan ng kumpanya na matugunan ang kanyang kabuuang liabilities (Non-current + Current Liabilities) gamit lamang ang kanyang Cash. Matatandaang ang cash ay ang pinaka liquid sa lahat ng mga assets dahil ito’y tinatanggan ninuman at hindi na kinakailangang ibenta pa para lamang ma-iconvert sa cash.

Kapag ang kumpanya ay mas mataas na ratio nito, ipinapahiwatig lamang nito na may sapat na cash ang kumpanya upang matugunan ang kanyang mga obligasyon at may napakaliit na chance na sya ay hindi makabayad dito.

Sa ikalawang bahagi nito, akin namang ipapaliwanag ang konsepto ng leverage ratios pati na rin ang valuation ratios na kalimitang ginagamit upang malaman kung overpriced ba o underpriced ang isang stock.

All that information is available to you, free of charge.

Balance sheet

The balance sheet is a snapshot of a company's financial position. The balance sheet reveals a firm's financial resources (their assets) and obligations (their liabilities) at a given moment in time. The asset column determines how well the company has done in handling its finances. On the other hand, the liabilities column does shows to whom and what the company is indebted to.

Income statement

The income statement summarizes a firm's financial transactions over a defined period of time, whether it's a quarter or a whole year. This means the money the company gains/ earns from engaging yourself into productive activities. On the other hand, expenses are the amount of money required to meet the company’s basic needs and other important needs necessary to live to exist. The income statement shows you money coming in (revenues, also known as sales) versus the expenses tied to generating those revenues.

Cash flow statement

income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. A company's sole reason for existing is to generate cash that can be distributed to shareholders. This dynamic is called a "positive cash flow."

Whether you are a , a small businessowner, a manager, an executive, a non-profit director, or just trying to keep track of your personal finances.