Taxation is principal method by which a government gains revenue into its budget. That revenue goes into a vast number of items, from paying debt, deafening the potential for implementing certain policies to paying for public services and welfare benefits and the military, etc.

Ano ang iba’t ibang uri ng klasipikasyon ng Taxable na Indibidwal?

1. Resident Citizen – Ito ay hindi binigyan ng kahulugan ng saligang batas. Ngunit ikaw ay isang resident citizen kung hindi ka maikakategorya ayon sa criteria ng isang Non-resident citizen.

2. Non-resident Citizen – ay isang Filipino citizen na:

a. Na-establish nya sa Commissioner na sya’y may intension na manirahan sa ibang bansa.

b. Iniwan ang Pilipinas sa taxable year para manirahan abroad, bilang isang immigrante o dili kaya ay para magtrabaho ng permanente.

c. Nagtatrabaho o nagdederive ng income nya mula sa abroad at ang kanyang pinagtatrabahuhan ay nirerequire sya na magtrabaho sa abroad ng majority nyang oras para sa taxable year.

d. Ikinonsidera nang non-resident at dumating sa Pilipinas ng kahit anong oras sa taxable year para manirahan na sa bansa ng permanente. Ang kinita nya mula sa abroad hanggnag dumating sya sa Pilipinas ay ikinokonsidera syang non-resident.

e. Kapag nakatira sa labas ng Pilipinas ng mahigit 183 days.

3. Resident alien – ito ang tawag naman sa mga foreigner (hindi citizen ng Pilipinas) at nakatira sa Pilipinas.

4. Non-resident alien engagaged in trade or business within the Philippines – non-resident alien naman ang tawag sa hindi residente at hindi rin citizen ng Pilipinas.

5. Non-resident alien not enagaged in trade or business within the Philippines

6. Special Aliens – Ito ang tawag sa mga empleyado ng mga multi-national companies, regional headquarters, offshore banking units, at petroleum contracts/ sub-contractors. Ang mga ito ay nakakatanggap ng kakaibang tax rate o special rate dahil na rin sa ambag ng mga kumpanyang ito sa ekonomiya ng bansa.

Para sa mga kababayan kong OFW, mahalagang malaman na ang mga OFW ay magiging taxable lamang sa mga income o kita na magmumula sa Pilipinas.

Sa kaso ng mga seaman, ito’y ikinokonsidera ng batas na OFW kung ang dalawang criteria sa ibaba ay nakamit:

1. Siya ay sumisweldo sa ibang bansa bilang miyembro/ empleyado ng barko.

2. Ang barko o vessel ay engaged lamang sa international trade

Isang praktikal na halimbawa nito ay kung ang seaman ay nagtatrabaho para sa barko ng Aboitiz na ang operasyon ay naririto lamang sa Pilipinas, hindi sya ikinokonsidera ng ating batas na isang OFW, bagkus ay siya’y maituturing na resident citizen. Dahil dito, siya ay magiging taxable sa lahat ng kanyang kinita sa loob maging sa labas ng bansa. A tax is an involuntary fee levied on corporations or individuals that is enforced by a level of government in order to finance government activities.

Ano ang iba’t ibang klase ng individual income tax?

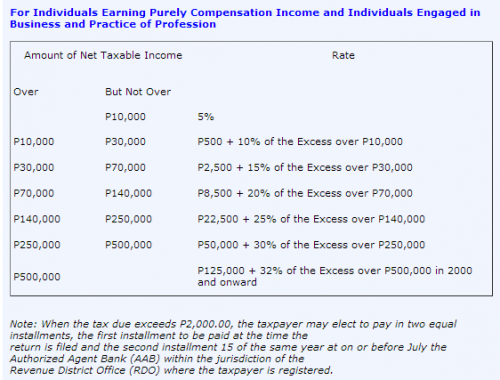

1. Net income Tax/ Normal o Basic Tax (5% - 32% progressive tax rates)

2. Final Income Tax sa passive income (proportional tax rates)

3. Capital Gains Tax sa capital gains.

Papaano kino-compute ang Basic Tax for Individual?

Ang formula sa pagcompute ay nasa ibaba:

Gross Income (excluding Passive and Capital Gains)

Less: Allowable Deductions

Net Taxable Income

X Tax Rates (ang listahan ng progressive tax rates ay nasa ibaba)

Net Income Tax Due

Less: Tax Credit (kung meron)

Tax Due (ang tax na kinakailangang bayaran)

Ang progressive tax rates ay ang sumusunod:

Source: http://www.bir.gov.ph

Taxes are used to pay for things like public education, welfare programs, transportation infrastructure, and defense funds.

Sa susunod kong mga articles, akin namang ipapaliwanag ng masinsinan ang tungkol sa formula ng Basic Individual Tax, kung ano ang komposisyon ng Gross Income, mga allowable deductions, at pati na rin ang ang mga exemptions na iyong makukuha.